Feie Calculator Can Be Fun For Anyone

Wiki Article

The Of Feie Calculator

Table of ContentsFeie Calculator for BeginnersThe Ultimate Guide To Feie CalculatorNot known Details About Feie Calculator The 25-Second Trick For Feie CalculatorNot known Factual Statements About Feie Calculator

He offered his U.S. home to establish his intent to live abroad completely and applied for a Mexican residency visa with his spouse to aid meet the Bona Fide Residency Test. Neil directs out that purchasing residential or commercial property abroad can be testing without first experiencing the area."We'll most definitely be beyond that. Even if we come back to the US for doctor's appointments or service calls, I doubt we'll invest greater than 1 month in the United States in any type of provided 12-month period." Neil highlights the relevance of rigorous monitoring of U.S. brows through (Foreign Earned Income Exclusion). "It's something that individuals require to be truly thorough concerning," he claims, and recommends deportees to be cautious of common errors, such as overstaying in the U.S.

Feie Calculator for Beginners

tax responsibilities. "The reason why U.S. tax on worldwide earnings is such a huge offer is since lots of individuals forget they're still subject to U.S. tax even after relocating." The united state is just one of the couple of nations that taxes its citizens no matter where they live, suggesting that also if an expat has no income from united statetax obligation return. "The Foreign Tax Credit report enables people operating in high-tax nations like the UK to counter their united state tax responsibility by the quantity they have actually currently paid in taxes abroad," says Lewis. This guarantees that expats are not strained two times on the exact same income. Those in reduced- or no-tax countries, such as the UAE or Singapore, face added difficulties.

Unknown Facts About Feie Calculator

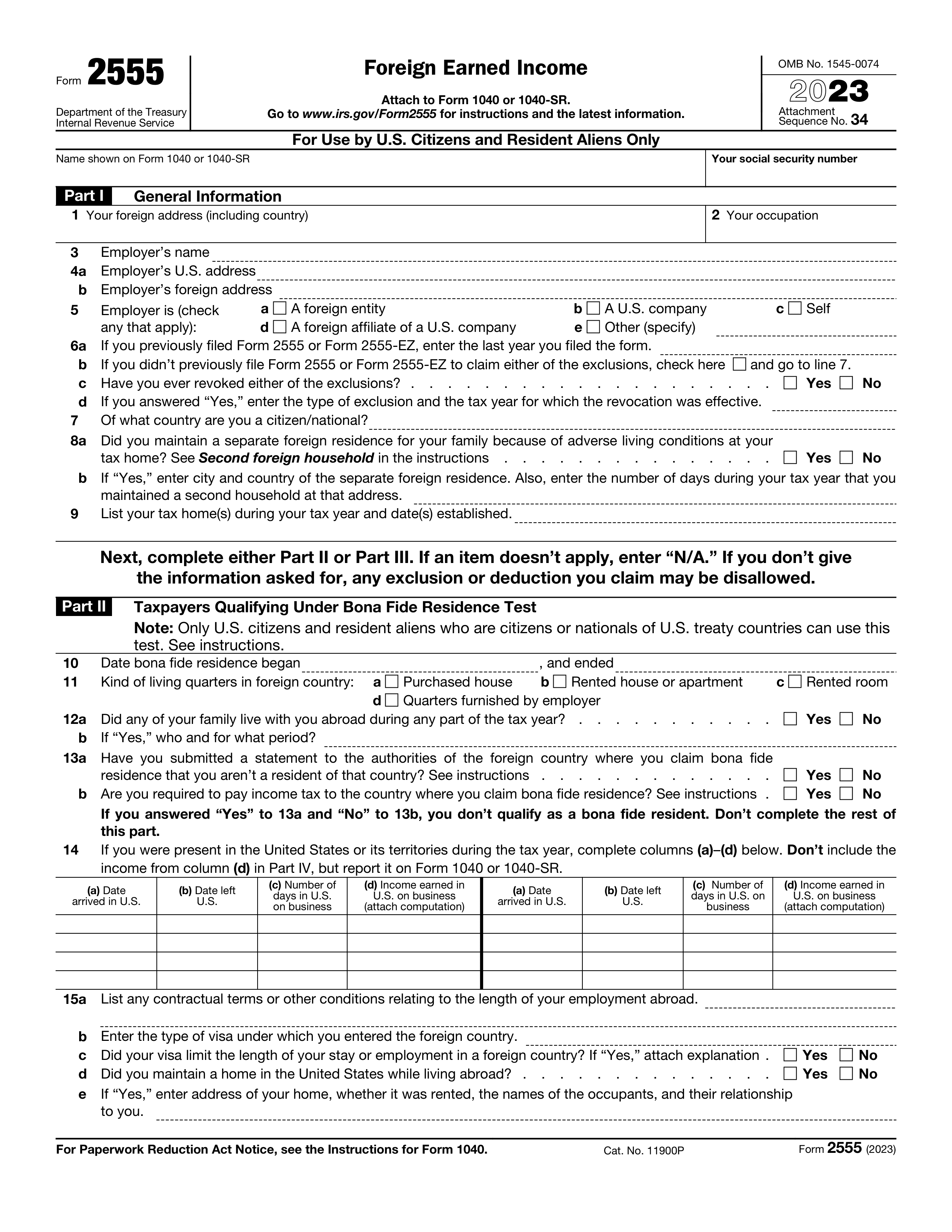

Below are several of one of the most regularly asked inquiries concerning the FEIE and various other exemptions The International Earned Revenue Exemption (FEIE) permits united state taxpayers to leave out up to $130,000 of foreign-earned income from federal earnings tax, minimizing their united state tax liability. To certify for FEIE, you must fulfill either the Physical Existence Test (330 days abroad) or the Bona Fide Residence Examination (confirm your key home in a foreign country for an entire tax obligation year).

The Physical Visibility Examination also needs United state taxpayers to have both an international revenue and an international tax obligation home.

How Feie Calculator can Save You Time, Stress, and Money.

An income tax obligation treaty between the U.S. and an additional nation can aid avoid double taxes. While the Foreign Earned Earnings Exemption reduces gross income, a treaty may give extra advantages for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a required declare U.S. citizens with over $10,000 in foreign economic accounts.Eligibility for FEIE depends upon conference particular residency or physical existence examinations. is a tax obligation advisor on the why not find out more Harness system and the creator of Chessis Tax obligation. He belongs to the National Association of Enrolled Agents, the Texas Culture of Enrolled Representatives, and the Texas Culture of CPAs. He brings over a years of experience benefiting Big 4 firms, encouraging expatriates and high-net-worth individuals.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax advisor on the Harness system and the creator of The Tax Man. He has over thirty years of experience and now specializes in CFO services, equity compensation, copyright taxation, marijuana taxation and separation relevant tax/financial preparation matters. He is a deportee based in Mexico - https://pxhere.com/en/photographer/4705000.

The foreign earned revenue exclusions, often described as the Sec. 911 exemptions, exclude tax obligation on salaries earned from functioning abroad. The exclusions consist of 2 parts - a revenue exemption and a housing exemption. The following Frequently asked questions discuss the advantage of the exemptions including when both spouses are deportees in a general manner.

The Ultimate Guide To Feie Calculator

The revenue exemption is currently indexed for inflation. The maximum annual earnings exemption is $130,000 for 2025. The tax obligation advantage leaves out the revenue from tax obligation at lower tax obligation rates. Formerly, the exclusions "came off the top" lowering revenue based on tax obligation at the top tax prices. The exemptions might or may not minimize earnings used for other functions, such as individual retirement account limitations, kid credits, individual exemptions, etc.These exclusions do not exempt the earnings from United States taxes however merely supply a tax reduction. Note that a solitary person working abroad for all of 2025 who earned concerning $145,000 without any various other earnings will certainly have gross income decreased to zero - efficiently the very same solution as being "free of tax." The exclusions are calculated every day.

Report this wiki page